georgia ad valorem tax out of state

Ad Valorem Vehicle Taxes If you. Does Georgias ad valorem tax require you to pay double taxes on out of state car.

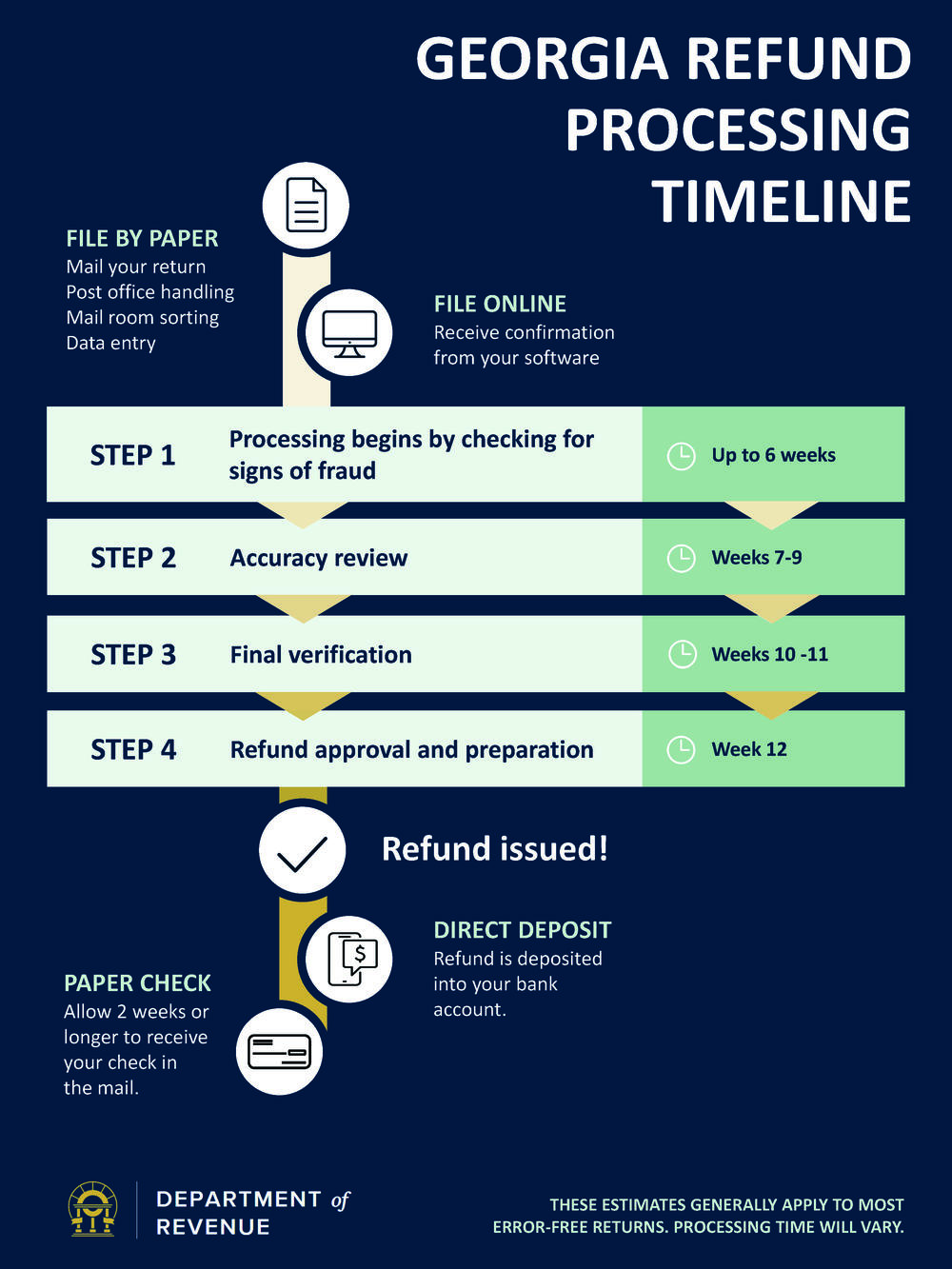

How To Register File Taxes Online In Georgia

The TAVT imposes a title tax at the time of purchase or initial registration in the state.

. Learn how Georgias state tax laws apply to you. Ad Access Tax Forms. 14000 the value of the car 007 the decimal-formatted TAVT rate 980 the amount.

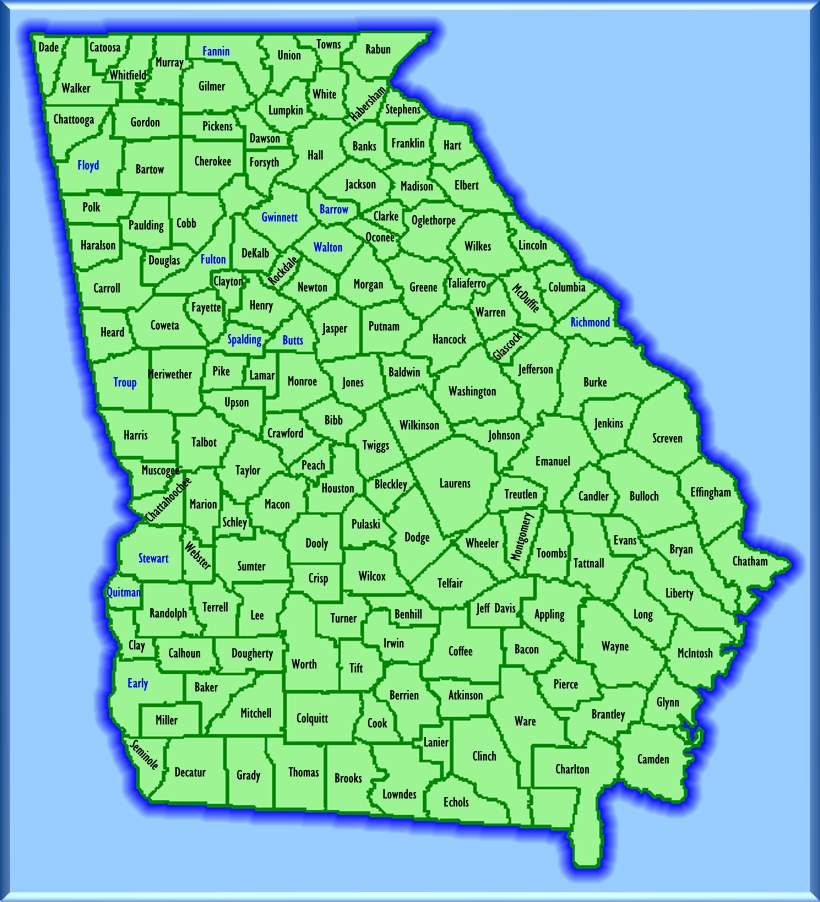

If you buy a car out of state and register it in Georgia then there is a 4 state sales tax. If youre a homeowner in Georgia youre probably well aware of the ad valorem property tax. Vehicles purchased on or after March 1 2013 and titled in Georgia are subject to Title Ad.

In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Theyll also weigh in on a series of questions and constitutional amendments.

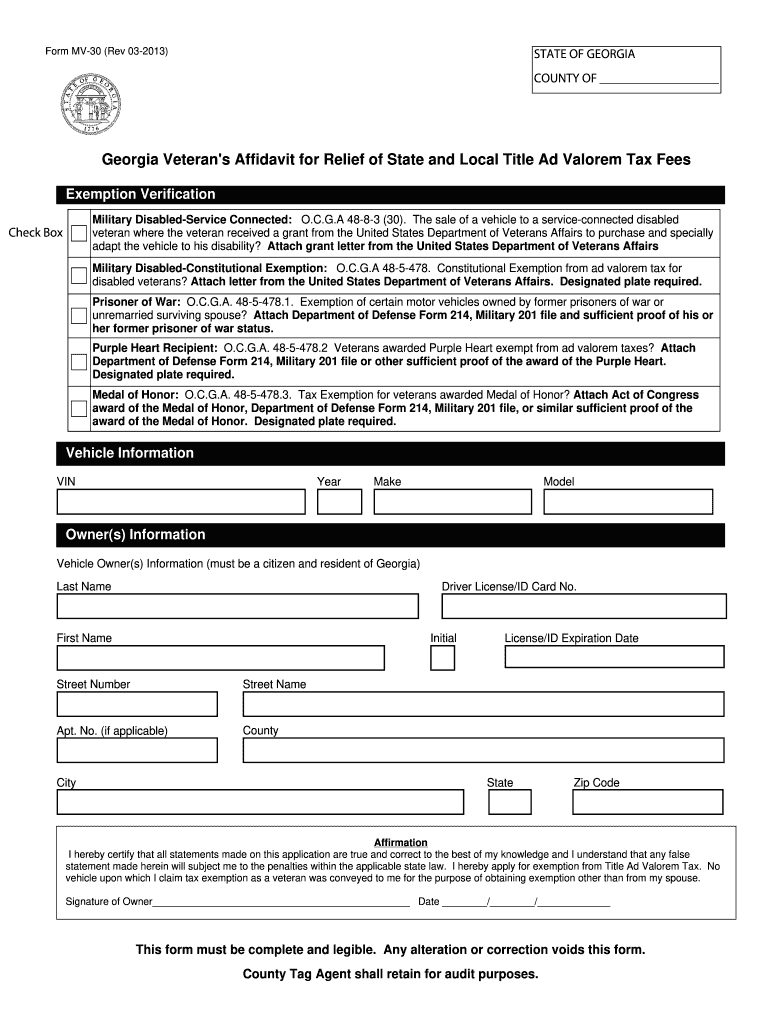

Using the IRS requirements Georgia will permit paid preparers to sign original returns. To obtain verification letters of disability compensation from the Department of Veterans Affairs. As a result the annual vehicle ad valorem tax sometimes called the.

Beginning March 1 2013 the Georgia tax rules applicable to motor vehicles changed. Updated April 6 2021 For the answer to this question we consulted the Georgia Department of. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to. Title Ad Valorem Tax TAVT became effective on March 1 2013. TAVT is a one-time tax that.

Complete Edit or Print Tax Forms Instantly.

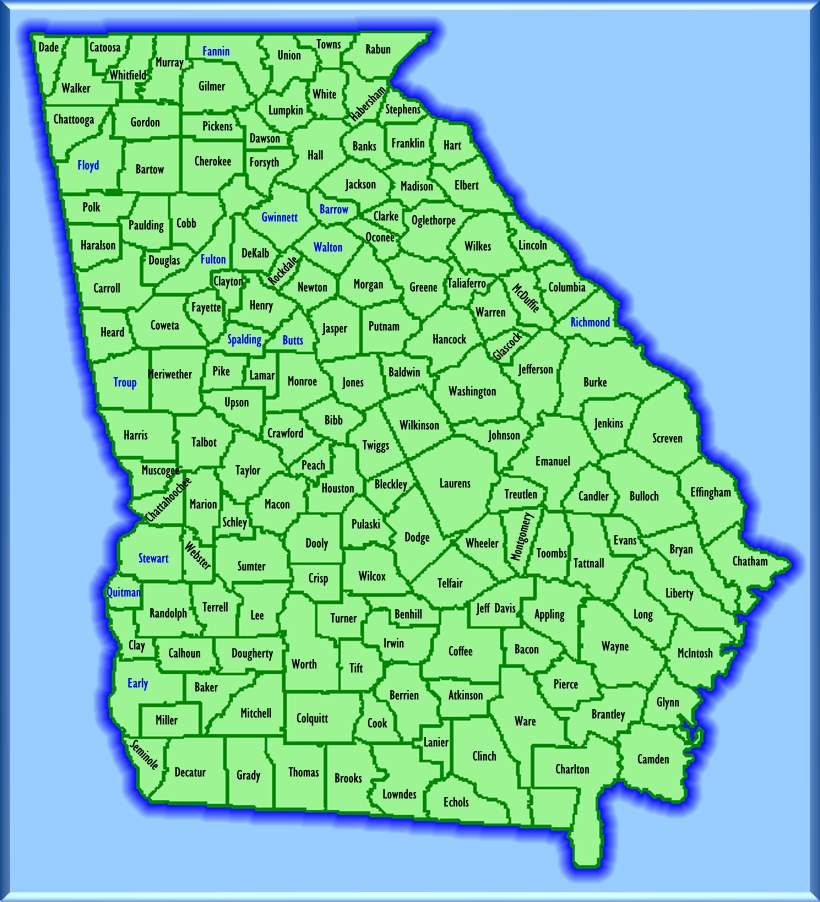

2021 Property Tax Bills Sent Out Cobb County Georgia

3 Simple Ways To Register A Car In Georgia Wikihow

Check My Refund Status Georgia Department Of Revenue

Georgia Title Ad Valorem Tax Updated Youtube

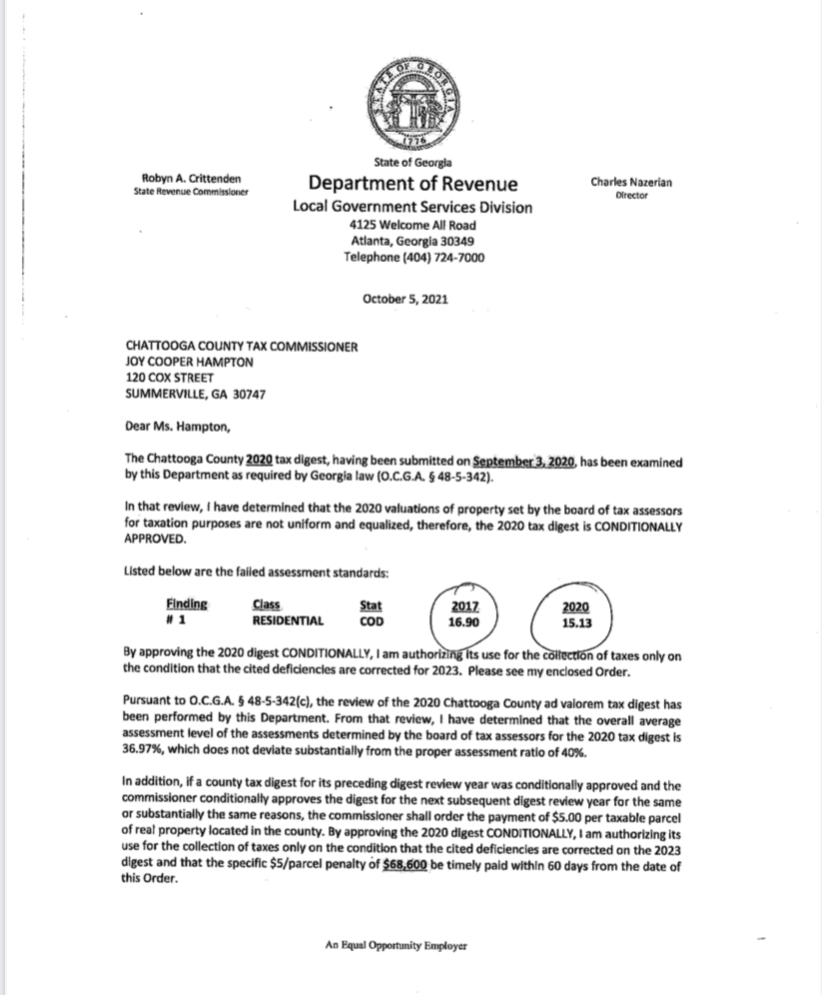

Chattooga County Fined 68 600 Will Appeal Allongeorgia

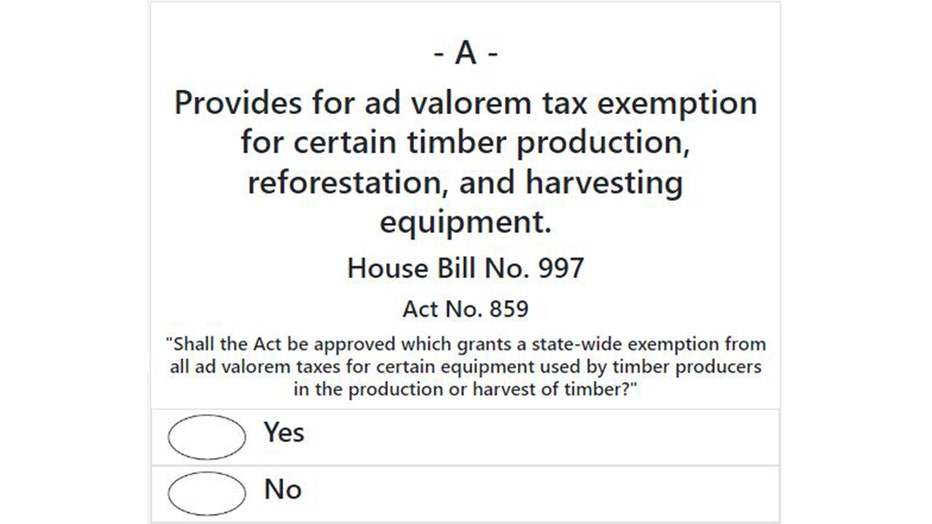

Georgia 2022 Statewide Ballot Questions Explained

Mv 30 Fill Out Sign Online Dochub

2022 Property Taxes By State Report Propertyshark

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

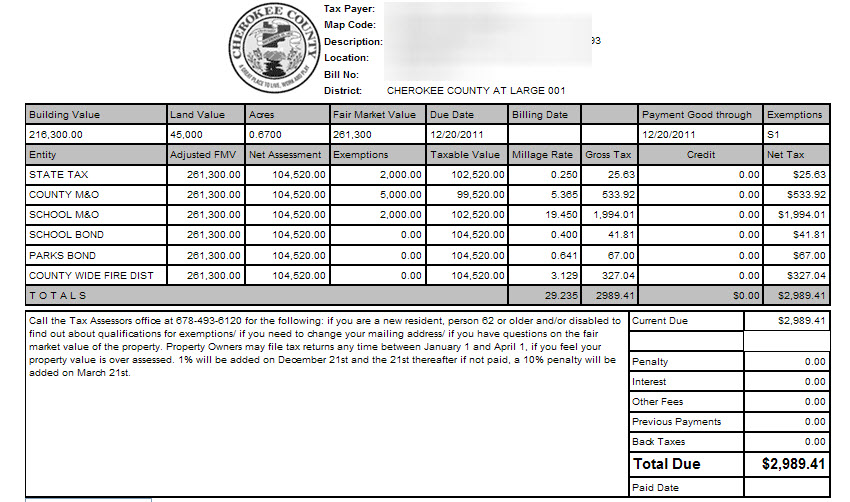

Tax Commissioner S Office Cherokee County Georgia

A Guide To Georgia Business Personal Property Taxes

Cherokee County Georgia Property Tax Calculator Unincorporated Millage Rate Homestead Exemptions

Legislation To Provide Senior Homestead Tax Exemption In Bartow Receives Final Passage In Georgia Senate Allongeorgia

Georgia Property Tax Appeals Explained By A Professional

Vehicle Taxes Dekalb Tax Commissioner

Georgia Amendments Proposals Results 2022 General Election

Georgia Department Of Revenue Changes To Georgia Law Impacting The Taxation Of Motor Vehicles Hb 386 Hb 266 And Hb Ppt Download